The world’s most popular cryptocurrency is now

worth over $2,000 per coin. That’s according to a range of bitcoin

exchanges, including Coinbase and Kraken. That valuation puts the total

market cap of bitcoin — the total number of coins in circulation — at

$32.92 billion.

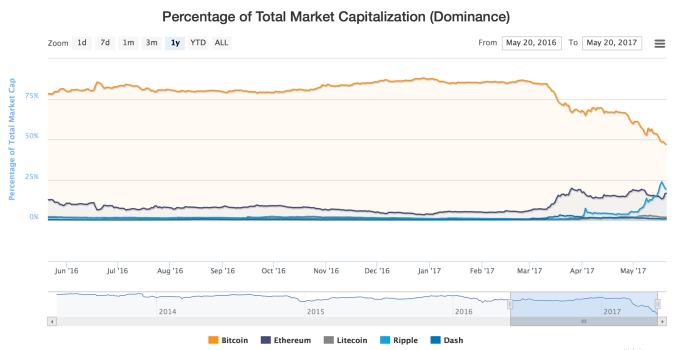

Bitcoin has been on a tear this year, as this chart from Coindesk shows.

Bitcoin first broke the $1,000 valuation mark way back in 2013, but a combination of factors — including the implosion of then-top exchange Mount Gox — saw the currency drop in value. Support from financial institutions trialed bitcoin and blockchain-based services, and a general stability following new regulation in China, saw bitcoin return to the $1,000 mark again at the end of last year. Since then, its valuation has continued to grow consistently through 2017.

When we wrote about bitcoin (and ethereum) hitting all-time highs back at the end of April, you could buy a bitcoin coin for $1,343. Now, some three weeks later, the valuation is up 50 percent. The price of a coin rose 12 percent over the past week alone.

But bitcoin isn’t the only cryptocurrency on the rise. Ripple, the centralized currency that is aiming to be a settlement protocol for major banks, has surged more than 10x, or 1000% in under a month making it now the second most valuable cryptocurrency (only behind bitcoin) in circulation.

Similarly, ethereum, a cryptocurrency designed to function as a blockchain-based computing platform for developers, is now trading $130 per coin with a total market cap of just under $12B, which represents a a little more than a 2x increase over the last month.

The result of these increases is that bitcoin no longer constitutes the majority of the market cap for all cryptocurrencies. Today the total market cap of bitcoin represents just 47% of total cryptocurrencies – up until a few months ago it consistently hovered around 80%.

Why have these other cryptocurrencies been performing so much better than bitcoin? Some say it’s because of bitcoin’s scaling issue. The currency has grown so large that the network is having trouble quickly confirming transactions unless users attach hefty fees for minors. And while the problem can be fixed with solutions like SegWit or Bitcoin Unlimited, the most powerful miners (who effectively control the codebase of bitcoin) haven’t been able to come to a consensus on which new protocol to implement.

While increases of 10x in a month would typically be an obvious sign of a bubble, it’s a little different with cryptocurrencies because no one really knows how much they should be worth. Unlike a company there are no assets or revenues we can use to assess a predictable valuation. So in one sense, a total cryptocurrency market cap of $70B is insane – considering there is no tangible value behind it.

But on the other hand, if (any of) these cryptocurrencies actually replace or supplant a global store of value like gold, then $70B is nothing. For example, the total estimated value of all gold mined is around $8.2 trillion USD. Meaning that right now all cryptocurrencies put together don’t even equal 1% of the world’s gold reserves. Similarly, there is currently about $1.5 trillion USD in circulation, meaning that all cryptocurrencies today are still worth less than 5% of USD in circulation.

The currency is in unchartered waters at $2,000, but some pundits believe it has the potential to reach $10,000 (or more). To achieve this the community would likely have to sort out the scaling issue, which would give investors confidence that bitcoin’s infrastructure be able to support it as it grows.

Featured Image: Mike Lewinski/Flickr UNDER A CC BY 2.0 LICENSE

Source: TechCrunch

Niciun comentariu:

Trimiteți un comentariu